+86-(0)768-6925905

Now that we understand the various reasons why you might need to cancel payroll in QuickBooks, let’s move on to the step-by-step guide to help you navigate this process seamlessly and efficiently. You will continue to access copies of your payroll tax returns online through the Canceled Client Payroll Tax Center until 12 months from the date of cancelation of the subscription. You’ll have access to your payroll data until one year after the date your subscription was canceled. Through your company fileThe best way to cancel your payroll service is directly in your QuickBooks Desktop company file. To cancel the payroll subscription, navigate to the QuickBooks Online Accountant or Company tab and click on the ‘Billing & Subscription’ section. Then, select the ‘Cancel Service’ option next to the payroll subscription.

Reverse the payroll liabilities

By removing direct deposit paychecks, you ensure that these payments are no longer considered valid and will not be processed by the banking system. This prevents any incorrect what does adjusted balance mean funds from being transferred to employees’ bank accounts, avoiding potential complications or confusion. The first step in cancelling payroll in QuickBooks is to review your payroll liabilities. Payroll liabilities include any outstanding amounts owed to employees, tax authorities, or other entities.

Cancel your QuickBooks Payments subscription

By completing this step, you prevent any incorrect or unauthorized payments from being processed and maintain accurate financial information. By deleting saved paychecks, you ensure that these unissued payments are no longer considered valid and will not be included in your payroll records. This helps maintain accurate financial information and prevents any incorrect calculations or reporting. By cancelling scheduled direct deposits, you ensure that funds will not be transferred to employees’ bank accounts as originally planned. This helps avoid any confusion, inconvenience, or potential financial discrepancies that may arise from incorrect payment processing.

Remember to consult with a qualified accountant or financial advisor before making any significant changes to your payroll. It is important to ensure compliance with tax regulations and maintain accuracy in your financial records. When reversing payroll liabilities, it’s important to double-check the information entered and ensure that the adjustments are accurate. Any discrepancies or errors in the reversal process can lead to incorrect financial reporting and may necessitate further adjustments.

By informing them about the cancellation, you provide transparency and clarity regarding any changes in their pay and ensure that they understand the reasons and implications of the cancellation process. Once you have reviewed your payroll liabilities and ensured their accuracy, you can proceed to the next step in cancelling payroll in QuickBooks. Once responsibility center definition your cancelation is complete, follow these steps to remove the QuickBooks Desktop Payroll Assisted service from your QuickBooks Desktop company file.

- The next scheduled payroll will be based on the new period dates you just entered.

- When I did the payroll on the older QBW file I added an employee from memory but the EDIT fields are not the same.

- By providing clear and timely communication, you can alleviate any potential anxiety and foster a positive work environment.

- Removing direct deposit paychecks, if applicable, is an essential step in the process of cancelling payroll in QuickBooks.

- Informing your employees about the cancellation of payroll in QuickBooks is an important step in the process.

- Once logged into your QuickBooks account, navigate to the ‘Billing & Subscription’ section to locate the payroll subscription settings.

Cancel your QuickBooks Online subscription or trial

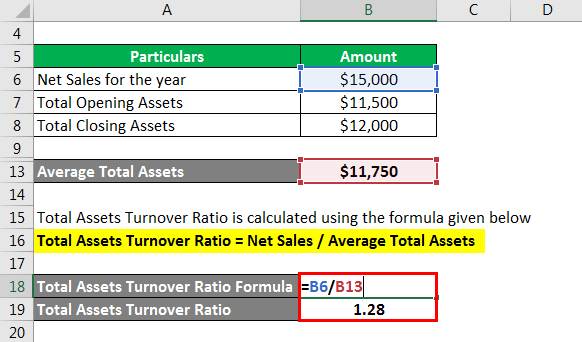

Regardless of the reason, it’s crucial to identify the need to cancel payroll promptly. Rectifying payroll errors or making necessary adjustments in a timely manner helps maintain accuracy, compliance, and employee trust. The central step in deleting payroll within QuickBooks involves accessing the payroll management section and initiating the deletion process, ensuring accuracy and compliance with payroll regulations. Once logged into your QuickBooks account, navigate to the ‘Billing & Subscription’ section to locate the payroll subscription settings. It’s important to review any pending payroll runs or tax filings before initiating the cancellation to ensure all necessary tasks are completed. It serves as a valuable resource for accounting purposes, internal auditing, and future reference if needed.

Your projects are processes,

Taking the time to review your payroll liabilities provides a solid foundation for the rest of the cancellation process. By following these step-by-step instructions, you can effectively cancel payroll in QuickBooks and ensure accurate financial records for your business. Before we delve into the detailed steps, it’s important to note that cancelling payroll in QuickBooks should be approached with caution. Any changes made to employee paychecks or tax calculations can have significant implications on your business’s financial records. It is recommended to consult with a qualified accountant or financial advisor before making any drastic changes to your payroll.

I’ll share insight on your query about deleting a scheduled payroll in your QuickBooks Online (QBO) company. Be advised, this option becomes available if there’s no employee assigned to the schedule you wish to delete. Transparency and effective communication with your employees are key during this process. Clearly explaining the reasons for the cancellation, the impact on employees’ pay, and the steps being taken to rectify how to get an ein business tax identification number any errors or changes help maintain trust and minimize confusion. It’s crucial to ensure that this step is completed to avoid any future billing or transactions related to the payroll service.