+86-(0)768-6925905

Content

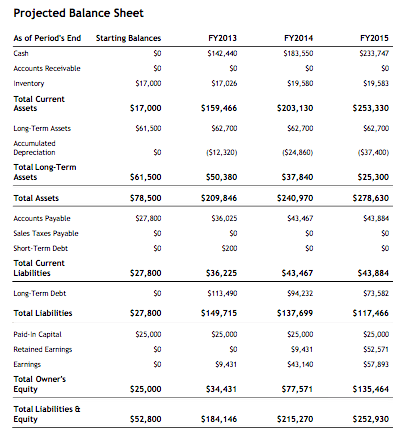

Simultaneously, each year, the contra asset account or accumulated depreciation will increase by $10,000. So, at the end of 3 years, the annual depreciation expense would still be $10,000. In this way, accumulated depreciation will be credited each year while the asset’s value is simultaneously written off until it is disposed of or sold.

The balance sheet would reflect the fixed asset’s original price and the total of accumulated depreciation. This is machinery purchased to manufacture products for the business to sell. Since the equipment is a tangible item the company now owns and plans to use long-term to generate income, it’s considered a fixed asset. Because organizations use the straight-line method almost universally, we’ve included a full example of how to account for straight-line depreciation expense for a fixed asset later in this article. Below are three other methods of calculating depreciation expense that are acceptable for organizations to use under US GAAP.

The Difference Between Carrying Cost and Market Value

Two of the most popular depreciation methods are straight-line and MACRS. You must decrease the value of an asset by the amount of depreciation and increase the balance for accumulated depreciation. The difference between the decrease and the accumulated depreciation is transferred to the income statement.

When accounting for business transactions, the numbers are recorded in the debit and credit columns. The debit and credit entries are used within a business’s chart of accounts to record every transaction. For every transaction recorded, a debit entry has to have a credit entry that corresponds with it while equaling the exact amount.

The accounting entry for depreciation

On most balance sheets, accumulated depreciation appears as a credit balance just under fixed assets. In some financial statements, the balance sheet may just show one line for accumulated depreciation on all assets. Assume that a company has lots of equipment with a total cost of $600,000 that is reported in the asset account Equipment. The company’s total amount of accumulated depreciation is $380,000 which appears as a credit balance in the contra asset account Accumulated Depreciation. Many companies depend on capital assets for part of their business operations and in accordance with accounting rules, they must depreciate these assets over their useful lives. As a result, they have to recognize the accumulated depreciation which appears on the balance sheet as a contra asset that reduces the gross amount of the fixed asset .

If you’re using different depreciation methods for your GAAP-basis financials and for tax purposes, you’ll have a book-tax difference for depreciation, which will go into calculating the company’s tax provision. At the end of the year, Company A uses the straight-line method to calculate the depreciation for the van, arriving at an annual expense of $2,000 ($20,000 purchase price / 10 years of useful life). However, there might be instances when the market value of a one-year-old computer may be less than the outstanding amount recognized in the balance sheet.

Normal Balance of an Account

Using the straight-line method, you depreciation property at an equal amount over each year in the life of the asset. For every asset you have in use, there is the “original basis” and then there’s the “accumulated depreciation” . The articles and research support materials available on this site are educational and are not intended depreciation expense credit or debit to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Depreciation For The EquipmentDepreciation on Equipment refers to the decremented value of an equipment’s cost after deducting salvage value over the life of an equipment.

- If you use credit card or another type of deferred payment, then you…

- From the view of accounting, accumulated depreciation is an important aspect as it is relevant for capitalized assets.

- When an asset set for disposal is sold, depreciation expense must be computed up to the sale date to adjust the asset to its current book value.

- Accountants use debits and credits to record each business transaction and generate financial statements.

- Closing stock refers to inventory done at the end of the fiscal year, often through a physical count using the market price of the items.

The sale of an asset for disposal purposes is similar to a regular asset sale. Unlike a regular disposal of an asset, where the asset is abandoned and written off the accounting records, an asset disposal sale involves a receipt of cash or other proceeds. Depreciation expenses are the allocated portion of the cost of a company’s fixed assets for a certain period which is recognized on the income statement. It is recorded as a non-cash expense that reduces the company’s net income or profit. It is said to be a non-cash expense because the recurring monthly depreciation entry does not involve a cash transaction. As regards this, the statement of cash flows prepared under the indirect method adds the depreciation expense back to calculate the cash flow from operations.

Debit or Credit?

If the balance sheet is ran at the end of the year, it would reflect a $50,000.00 asset less $10,000.00 of accumulated depreciation. The term “double-declining balance” is due to this method depreciating an asset twice as fast as the straight-line method of depreciation. The “2” in the formula represents the acceleration of deprecation to twice the straight-line depreciation amount. However, when using the declining balance method of depreciation, an entity is not required to only accelerate depreciation by two.

As earlier said the offset to the depreciation expense debit entry would be a credit to the accumulated depreciation account (which is a contra-asset account). A contra-asset account has a contrary entry to the natural debit balance of the asset account. From the view of accounting, accumulated depreciation is an important aspect as it is relevant for capitalized assets.

Join over 140,000 fellow entrepreneurs who receive expert advice for their small business finances

Still, there are two methods primarily used for the calculation – straight line and double-declining balance. Double-entry bookkeeping approaches every transaction as containing two sides, a credit and a debit. Whenever a debit is created somewhere in a business, a credit is inevitably created elsewhere . The accumulated depreciation of the van will increase by $2,000 for each year of its useful life. Accumulated depreciation is the total amount of depreciation expense that has been allocated to an asset since it was put in use. The company uses the fixed installment method of depreciation and estimates that the machine will have a useful life of 6 years, leaving a scrap value of $2,000.

Some companies don’t list accumulated depreciation separately on the balance sheet. Instead, the balance sheet might say “Property, plant, and equipment – net,” and show the book value of the company’s assets, net of accumulated depreciation. In this case, you may be able to find more details about the book value of the company’s assets and accumulated depreciation in the financial statement disclosures. To find accumulated depreciation, look at the company’s balance sheet. Accumulated depreciation should be shown just below the company’s fixed assets. At the end of each financial year, debit the depreciation expense account and credit the provision for depreciation with the amount of depreciation calculated for the year.

Why is depreciation an expense?

Depreciation is considered to be an expense for accounting purposes, as it results in a cost of doing business. As assets like machines are used, they experience wear and tear and decline in value over their useful lives. Depreciation is recorded as an expense on the income statement.