+86-(0)768-6925905

Contents:

If you have limited capital, consider a brokerage that offers high leverage through a margin account. If you have plenty of capital, any broker with a wide variety of leverage options should do. A variety of options lets you vary the amount of risk you are willing to take.

If the trader went long on EUR/CAD they would be paying 11.87 EUR each night for the position resulting in a negative carry. But if the exchange rate appreciated, the profit from the trade may offset any accumulated overnight swap fees. However please notice, that past performance is not necessarily an indication of future performance.

However, when you apply it to the spot forex market, with its higher leverage and daily interest payments, sitting back and watching your account grow daily can get pretty sexy. A trader using this strategy attempts to capture the difference between the rates, which can be substantial depending on the amount of leverage used. The trader is paying a low-interest rate on the borrowed currency while collecting the return on the higher interest rate of the currency purchased.

Define Your Method of Analysis

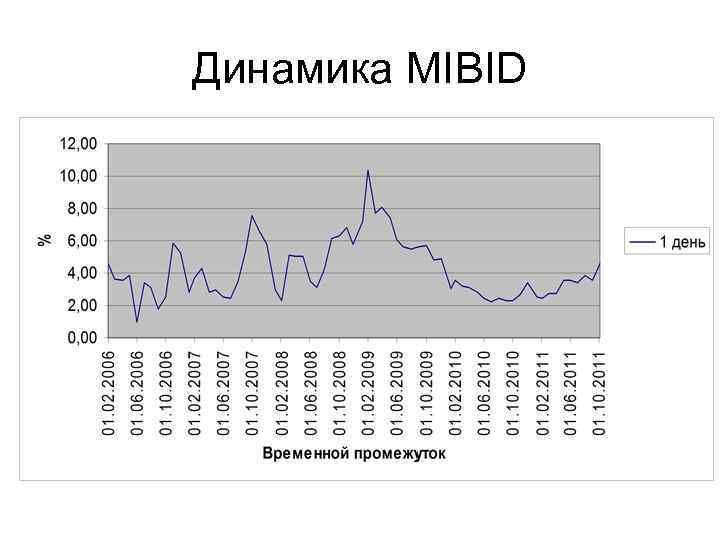

The carry trade strategy is best suited for sophisticated individual or institutional investors with deep pockets and a high tolerance for risk. Rollover rates are based on current interest rates set by central banks. They tend to be stable during normal market conditions but can change drastically overnight if the interbank market becomes stressed or central banks decide to change rates. It’s useful to keep a calendar of central bank rate decisions on hand so you’re not caught off guard.

- In the table, pay attention to the pairs with the largest difference in discount rates.

- After that, they need to borrow or sell the low-yielding currencies to buy high-yielding currencies to obtain profits on their interest rate differences.

- Place your trade 24-hours a day, five days a week – from 9pm Sunday evening to 10pm Friday night on our award-winning platform.

- A positive swap is credited every day, a negative swap is deducted.

For example, less leverage may be preferable for highly volatile currency pairs. USD/CHF has the largest swap size that makes it the most attractive pair for carry traders. Speaking about a trend, the negative interest rate on Swiss franc will further boost this currency pair. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading.

Forex

One can also conduct the strategy in gold carry trade where traders borrow gold at a low gold lease rate and use it to fund other high-yielding assets to profit from their interest rate difference. Carry trades will also fail if a central bank intervenes in the foreign exchange market to stop its currency from rising or to prevent it from falling further. Therefore if the Aussie or Kiwi, for example, gets excessively strong, the central banks of those countries could resort to verbal or physical intervention to stem the currency’s rise. Any hint of intervention could reverse the gains in the carry trades. The purpose of a carry trade is to profit from the difference in interest rates or the “interest rate differential” between two separate foreign currencies in a pair.

A negative how to convert a property into an hmo trade involves borrowing a currency with a high-interest rate while buying a currency with a low-interest rate. The trader will incur a loss on the interest rate differential and have to pay interest for holding the position. After reading this article, you will know what the Carry Trade strategy is and what its advantages are. Learn how to use it to make money on the foreign exchange market, all the while minimizing the risks typical for this trading strategy.

It’s Time To Take Your Learning To The Next Level

Many people are jumping onto the carry trade bandwagon and pushing up the value of the currency pair. Similarly, these trades work well during times of low volatility since traders are willing to take on more risk. As long as the currency’s value doesn’t fall — even if it doesn’t move much, or at all — traders will still be able to get paid. Currency values, exchange rates, and prevailing interest rates are always fluctuating, so no single currency is always best. In general, the most popular carry trades involve buying pairs with the highest interest rate spreads. True, carry traders, including the leading banks on Wall Street, will hold their positions for months at a time.

To make a profit from the yen carry trade, the JPY key interest rate must be lower than the AUD rate. Forex trading is the exchange of currencies on the foreign exchange market. Trading occurs in currency pairs such as the EUR/USD (the euro versus the U.S. dollar) and the USD/CAD (the U.S. dollar versus the Canadian dollar). The foreign exchange market is the most actively traded market in the world. A currency carry trade is a strategy in which a trade is funded with a high-yielding currency and a low-yielding currency.

A currency carry trade is a strategy that involves borrowing from a lower interest rate currency and to fund purchasing a currency that provides a rate. There is always the option to practise your carry trade strategy first with a forex demo account. This comes with £10,000 worth of virtual funds so that you can trade risk-free on our platform. This article will provide traders with a brief guide to short-term Forex trading strategies.

The swap value is set in the specification in the trading conditions of the broker or on the trading platform. Carry Trade in simple terms is when a person borrows a cheap resource in order to buy an expensive one. Their trading gains are the interest differential between the yield of the expensive resource and the loan payment.

In this article, we will talk about the best-suited currency pairs for the carry trade strategy.

Even if the exchange rate between the two currencies remains unchanged, the trader will profit from the overnight interest payment. However, over time, central banks deem it necessary to alter interest rates and this poses a potential risk to the carry trade strategy. For example, the Japanese yen is a popular funding currency for carry trades because the country seeks to maintain near-zero interest rates.

However, carry trade usually sustains those opportunities unless the expectations of rate cycle changes dramatically. Using the forex carry trade strategy, a trader aims to capture the benefits of risk-free profit making by using the difference in currency rates to make easy profits. The funding currency is the currency that is exchanged in a currency carry trade transaction. Federal Reserve often engaged inaggressive monetary stimuluswhich results in low-interest rates. These banks will use monetary policy to lower interest rates to kick-start growth during a time of recession.

Decentralized Forex Trading: The Next Evolutionary Step – Finance Magnates

Decentralized Forex Trading: The Next Evolutionary Step.

Posted: Tue, 24 May 2022 07:00:00 GMT [source]

The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any https://1investing.in/ or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. If the loss brings the account down to the amount set aside for margin, then the position is closed and all that’s left in the account is the margin – $1000.

How Federal Reserve & Indian Markets are co-related?

The most popular carry trades involve buying currency pairs like the AUD/JPY and the NZD/JPY, since these have interest rate spreads that are very high. The currency carry trade is one of the most popular trading strategies in the currency market. Consider it akin to the motto “buy low, sell high.” The best way to first implement a carry trade is to determine which currency offers a high yield and which offers a lower one. Partly due to the demand for the carry trades, trends in the currency market are strong and directional. The other risks of carry trades include the appreciation or depreciation of the market you are trading. A trader may benefit from a positive carry and receive positive daily interest payments if they went long, or bought a market, at a certain price.

USDJPY Implied Volatility Suggests Traders Ready for Fireworks – DailyFX

USDJPY Implied Volatility Suggests Traders Ready for Fireworks.

Posted: Wed, 18 Jan 2023 08:00:00 GMT [source]

Premium accounts, which often require significantly higher amounts of capital, let you use different amounts of leverage and often offer additional tools and services. Also, a forex broker should be registered as a Futures Commission Merchant and regulated by the Commodity Futures Trading Commission . In an attempt to get into higher probability trades, traders should first look to confirm the uptrend which, in the below chart, is confirmed after the higher high and higher low. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website. This is the cost of “carrying” (also known as “rolling over“) a position to the next day.

At year-end, if the exchange rate between the dollar and EC is the same, the return on this carry trade is 5% (6% – 1%). If the EC has appreciated by 10%, the return would be 15% (5% + 10%). However, if the EC depreciates by 10%, the return would be -5% (5% – 10%). A currency carry trade is a strategy that involves using a high-yielding currency to fund a transaction with a low-yielding currency. The profitability of the carry trades comes into question when the countries that offer high-interest rates begin to cut them.

- Their trading gains are the interest differential between the yield of the expensive resource and the loan payment.

- In this article, you will learn the answer to ‘what is scalping in Forex’, how it works and how to choose your own Forex scalping trading system.

- Also, carry trades only work when the markets are complacent or optimistic.

- You can also put your carry trading skills to the test on our free demo account before you commit to investing real money.

Even if you have enough cash to cover the change in value, some brokers will liquidate your position on a margin call at the low. Unlike equity brokers, forex brokers are usually tied to large banks or lending institutions because of the large amounts of capital required . The spread, calculated in pips, is the difference between the price at which a currency can be purchased and the price at which it can be sold at any given point in time.

However, if the yen got stronger, the trader would have earned less than the 3.5% interest spread or might have even incurred a loss. The strategy is suitable for traders as an additional income to exchange rate movements trading, as well as passive investors with large capital. You determine the amount of capital yourself, based on your profit targets.

Carry trade is a strategy for making a profit on the foreign exchange market due to the interest rate difference of different countries, on whose currencies the trader earns. The strategy works on currency pairs and is tied to the discount rates of the central banks. Sometimes the term “carry trade” is applied to other assets – commodities and derivatives. An effective carry trade strategy does not simply involve going long a currency with the highest yield and shorting a currency with the lowest yield.

A trader opens up a trading account and opens a trade for one mini-lot which is the equivalent to 10,000 units of currency. To open this trade the trader does not need $10,000 in her account to do so, the broker only requires a certain margin or deposit to be put aside. How you can use a carry trade strategy through a completely risk-free demo trading account. Swap income with a minimum trade volume for several days amounts to mere cents. A trader can use margin trading, thus increasing the risks, or increase the volume of the deposit and, accordingly, the position, all the while freezing the money for a long time. The analysis should be carried out on weekly and monthly timeframes.

USD/HKD: Carry trade opportunities emerge as Hibor plunges – InvestorsObserver

USD/HKD: Carry trade opportunities emerge as Hibor plunges.

Posted: Tue, 14 Feb 2023 08:00:00 GMT [source]

Gordon Scott has been an active investor and technical analyst or 20+ years. All references on this site to ‘Admirals’ refer jointly to Admiral Markets UK Ltd, Admiral Markets Cyprus Ltd, Admiral Markets AS Jordan Ltd, Admirals AU Pty Ltd and Admirals SA Ltd.