+86-(0)768-6925905

Contents

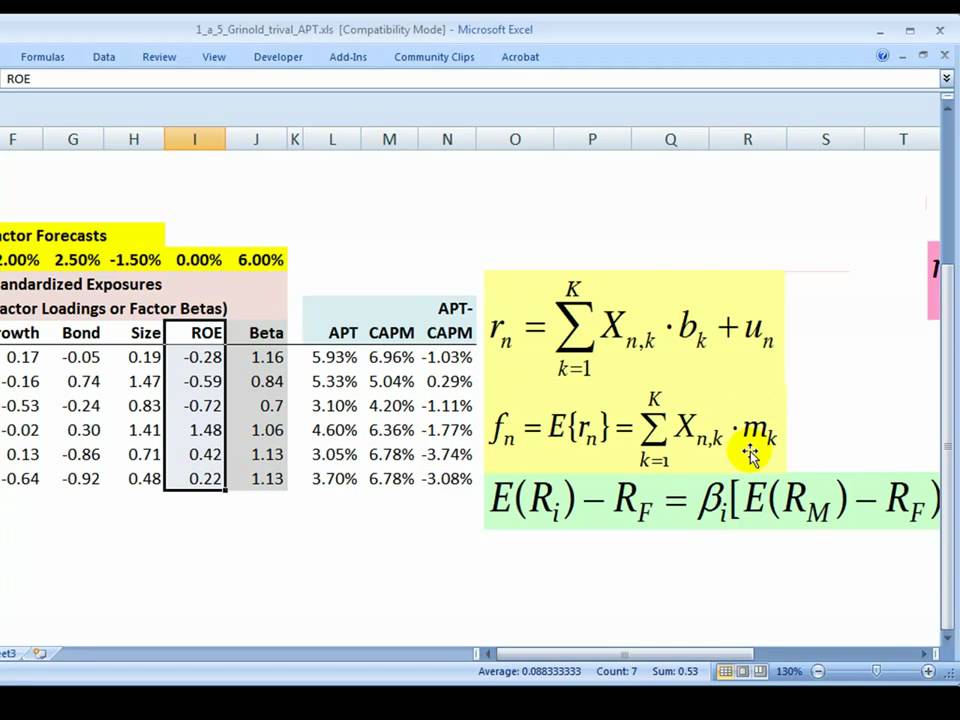

The Score is named after Stanford Accounting Professor, Joseph Piotroski. Hit ‘reply’ to any email from us! We do not offer personalized investment advice. We can write a detailed article without mentioning your name if you have a generic question. With these metrics a company can be given a Piotroski Score.

Watch the first lecture for free! Reduce fear, uncertainty and doubt while investing! Learn how to plan for your goals before and after retirement with confidence. If this financial years ROA is greater than previous financial years ROA, one point. For more resources, check out our business templates library to download numerous free Excel modeling, PowerPoint presentation, and Word document templates. If a company has a score of 8 or 9, it is considered a good value.

Higher the score, better the strength of the company and confidence it its operation. The quality of company’s earnings based on its profit realization and excludes non cash items. The Piotroski score is a discrete score between 0-9 that reflects nine criteria used to determine the strength of a firm’s financial position. Get clarity on how to plan for your goals and achieve the necessary corpus no matter what the market condition is!!

The Piotroski F-Score is a combination of 9 criteria that reflects the financial strength of companies. It is a discrete score between 0 to 9. For every criterion met out of 9 criteria one point is rewarded.

II. Leverage, Liquidity and Source of funds

We do so without conflict of interest and bias. CFI’s Piotroski F score calculator can be used to assess a company’s financial strength by looking at nine factors. A score of either 0 or 1 is rewarded for each of these factors, depending on whether it has been fulfilled or not.

This metric is useful to judge value stocks.more .. Version 8 of the freefincal stock analyzer computes the Piotroski Score using 10-year financials from Morning Star India. Thus the score is obtained for the last 9 financial years.

There are few measures available to screen the stocks such as Piotroski F-Score, Altman Z-Score, Modified C-Score etc. Here I want to explain one of the popular metrics among these i.e. Screener tracking stocks with a High Piotroski Score (the well-known piotroski score checks the company’s financial strength). To get notified of changes to the screener, set an alert. Liquidity.The Current ratio is current assets divided by current liabilities. One point if last reported current ratio is greater than that for the previous financial years.

Search the site

Fintel makes no representations or warranties in relation to this website or the information and materials provided on this website. Nothing on this website constitutes, or is meant to constitute, advice of any kind. If you require advice in relation to any financial matter you should consult an appropriate professional.

Another part of stock picking is finding the right time to enter the market. Hence, any investor before going long for a stock has to do both fundamental https://1investing.in/ analysis and technical analysis. And these analyses need our time and a bit of research. But what if we have an instant score for this.

Contact Freefincal

The fundamental task in investing is finding mispricings in price v. quality. There are a lot of cheap companies in the market, but most of them are cheap for very good reasons. The trick is finding companies that are cheap but actually healthy. He showed that this score, combined with a valuation metric (he used Book-To-Market), could be used successfully to produce excess returns in an investing strategy. This stock screener finds all companies with a score greater than six (which we call “healthy enough”).

In general, large cap stocks have high volatility still it is a good start to pick. This score gives a overall view of company’s growth and performance. You can find this score in money control, screener and other screening websites. But it is most important to consider the other factors such as business model, industry in which the company operates, peer company metrics and other financial ratios. For an investor, the most critical part is picking the right stocks for investment. Especially in these times of recession, only the companies which are fundamentally deep can sustain and beat the market with the character.

- You can find this score in money control, screener and other screening websites.

- But it is most important to consider the other factors such as business model, industry in which the company operates, peer company metrics and other financial ratios.

- The Structured Query Language comprises several different data types that allow it to store different types of information…

- For DIY investors, this score can be used as a starting point in filtering the mid cap and small cap stocks for medium to long term.

- In general, large cap stocks have high volatility still it is a good start to pick.

Since in all the screening apps only one year’s score is available it becomes difficult to trust this metric. This Piotroski F score calculator will help you assess the strength of a company’s financial state. The Piotroski F score uses nine factors taken from a firm’s financial statements. Using these factors, it calculates a measure of the strength of a firm’s financial position.

Piotroski Score – An instant metric for stock screening

The higher the score, the more reliable a stock is to invest in. These factors are categorized into three different sources of financial strength that analysts like to look at. This score compares the performance of the company with the previous year only. After 2021 annual results, this score can be high for most of the stocks, as in 2020, they showed poor performance.

If the score adds up to between 0-2 points, the stock is considered weak. Give 1 point if the current period’s Gross margin is higher compared to the Gross margin of the previous period; otherwise give 0 points. ” an organisation for promoting unbiased, commission-free investment advice. Do share this article with your friends using the buttons below.

One point if the shares outstanding has remained the same or decreased. SQL Data Types What are SQL Data Types? The Structured Query Language comprises several different data types that allow it to store different types of information… This website is provided “as is” without any representations or warranties, express or implied.

The automated stock analysis Excel sheet now calculates thePiotroski Score for the last 9 financial years for Indian stocks. Piotroski F-Score is a number between piotroski score screener india 0-9 which is used to assess strength of company’s financial position. The Score is used by financial investors in order to find the best value stocks .